How Co-Buying a Home Helps with Affordability Today

Buying a home in today’s market can feel like an uphill battle – especially with home prices and mortgage rates putting pressure on your budget. If you’re feeling stuck, co-buying could be one way to help you get your foot in the door. Freddie Mac says: “If you are an aspiring homeowner, buying a ho

Read More

The Benefits of Using Your Equity To Make a Bigger Down Payment

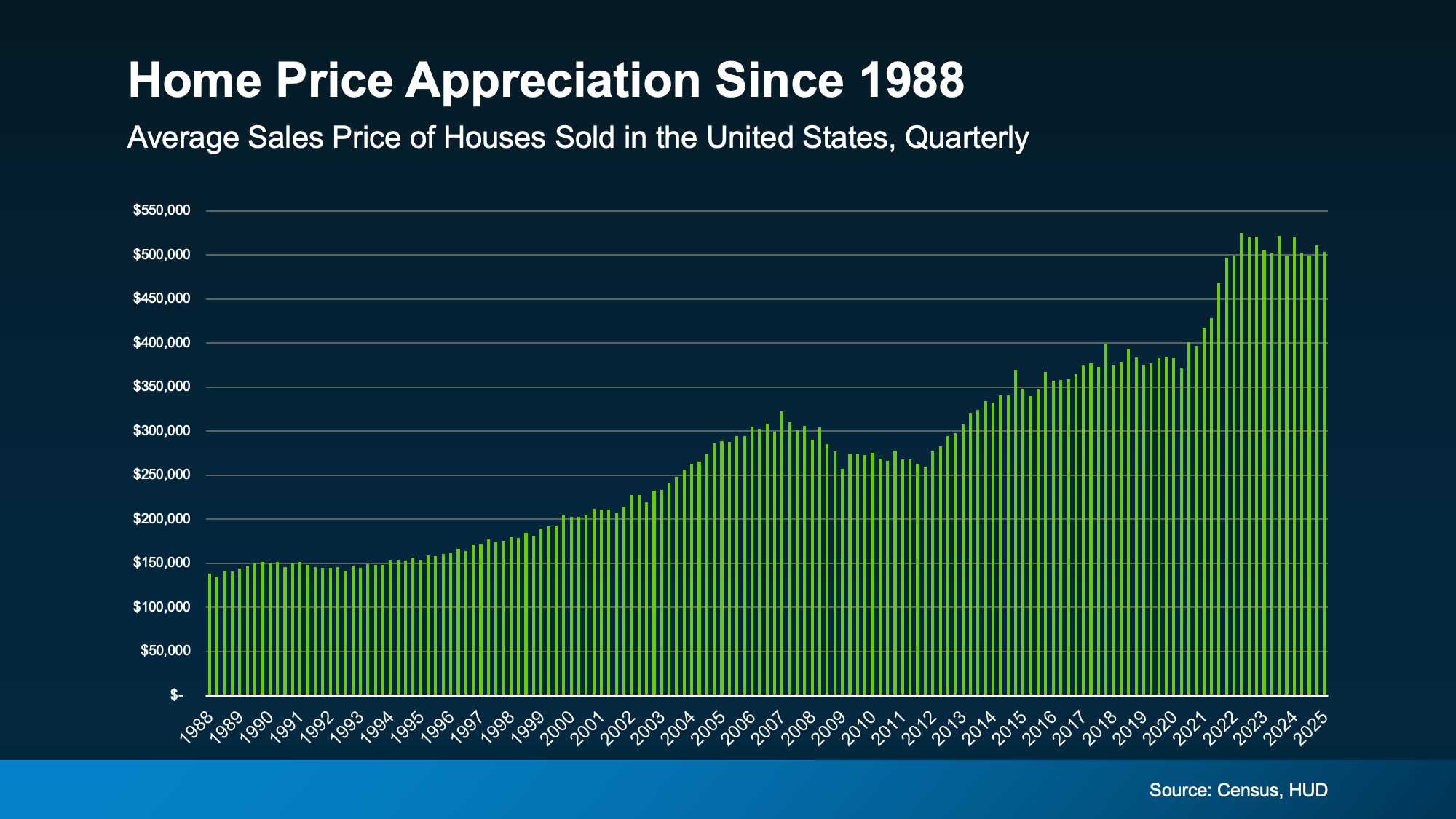

According to the latest data from Redfin, the typical down payment for U.S. homebuyers is $67,500—that’s nearly 15% more than last year, and the highest on record (see graph below): Here’s why equity makes this possible. Over the past five years, home prices have increased significantly, which has l

Read More

What Credit Score Do You Really Need To Buy a House?

When you're thinking about buying a home, your credit score is one of the biggest pieces of the puzzle. Think of it like your financial report card that lenders look at when trying to figure out if you qualify, and which home loan will work best for you. As the Mortgage Report says: "Good credit sco

Read More

Categories

Recent Posts