Is It Better To Rent or Buy a Home?

With high home prices and stubborn mortgage rates, renting can seem like the safer choice right now. Or maybe your only choice. That’s a very real feeling. And perhaps buying today isn’t your best move; it’s not for everyone right away. You should only buy a home when you’re ready and able to do it,

Read More

How Co-Buying a Home Helps with Affordability Today

Buying a home in today’s market can feel like an uphill battle – especially with home prices and mortgage rates putting pressure on your budget. If you’re feeling stuck, co-buying could be one way to help you get your foot in the door. Freddie Mac says: “If you are an aspiring homeowner, buying a ho

Read More

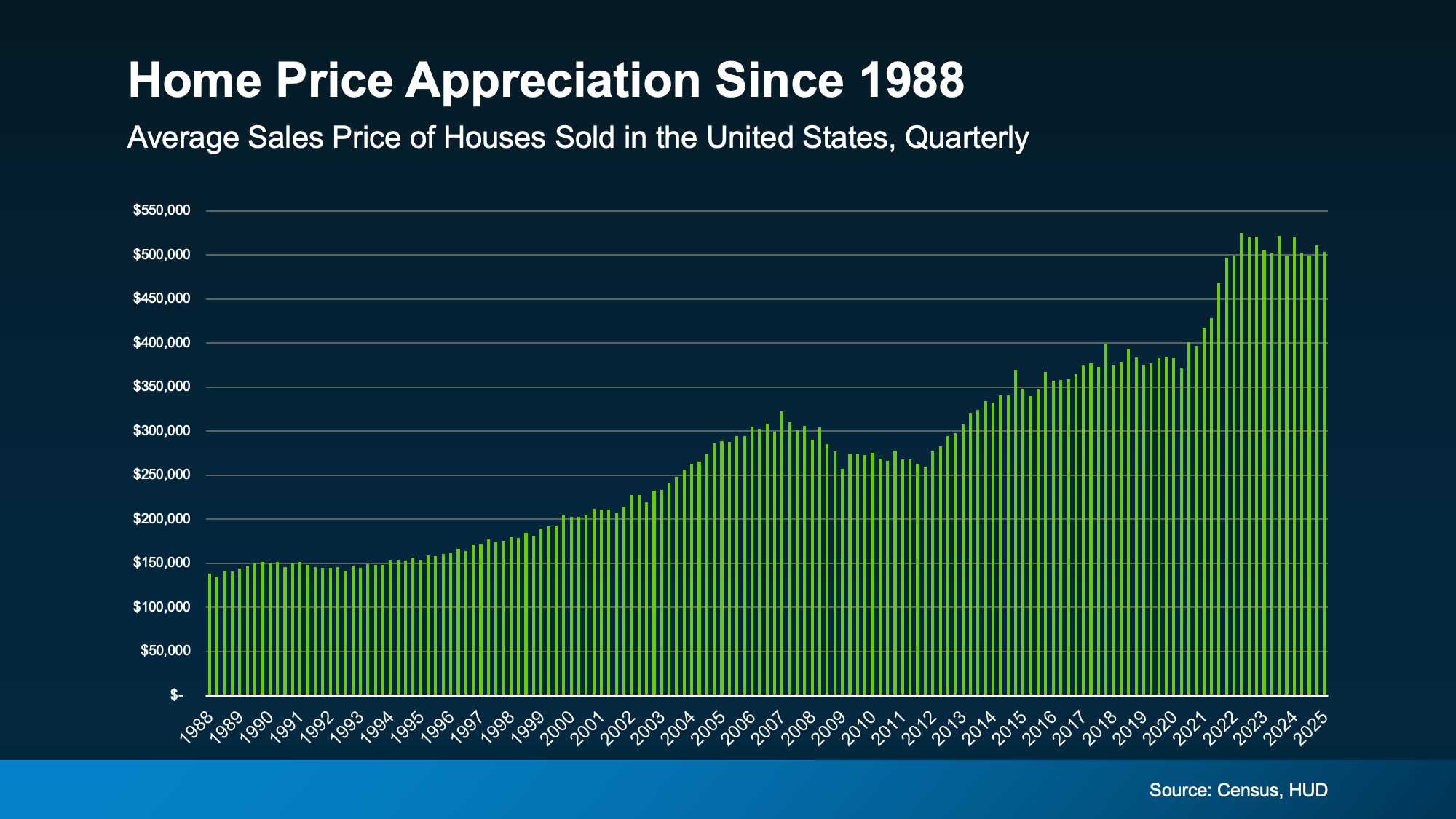

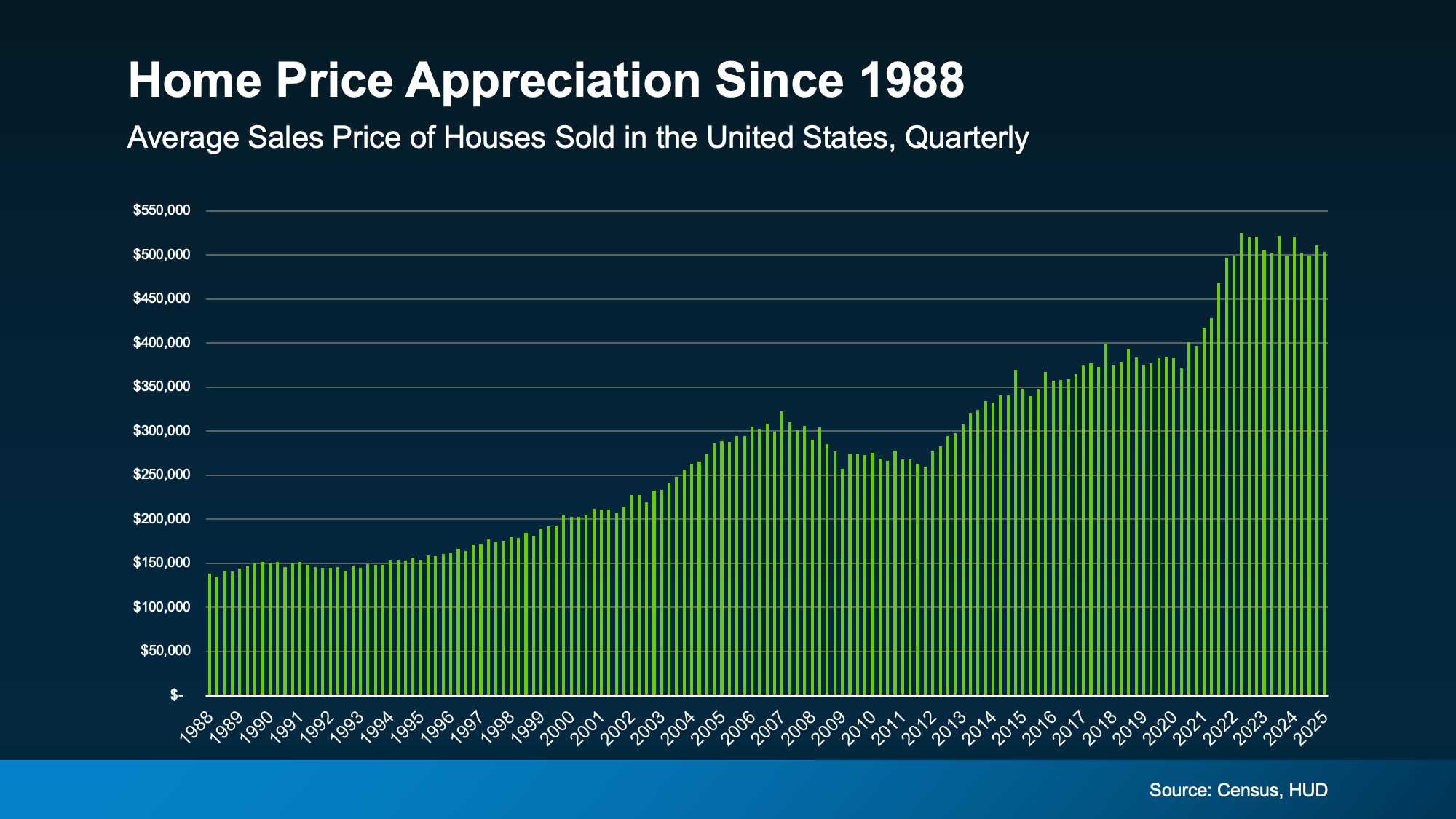

What To Expect from Mortgage Rates and Home Prices in 2025

Curious about where the housing market is headed in 2025? The good news is that experts are offering some promising forecasts, especially when it comes to two key factors that directly affect your decisions: mortgage rates and home prices. Whether you're thinking of buying or selling, here’s a look

Read More

Categories

Recent Posts